NEW POLLING ON RESPONSIBLE INVESTING (FORMERLY KNOWN AS ESG)

tags

Summary

Ahead of President Biden’s likely first veto on legislation that would undo the Department of Labor’s rule relating to responsible investing, commonly referred to as Environmental, Social and Governance (ESG), Climate Power and Data for Progress conducted a national survey from March 3 to 6, 2023 of 1,226 likely voters. The poll gauges support for the anticipated veto and on the issue overall.

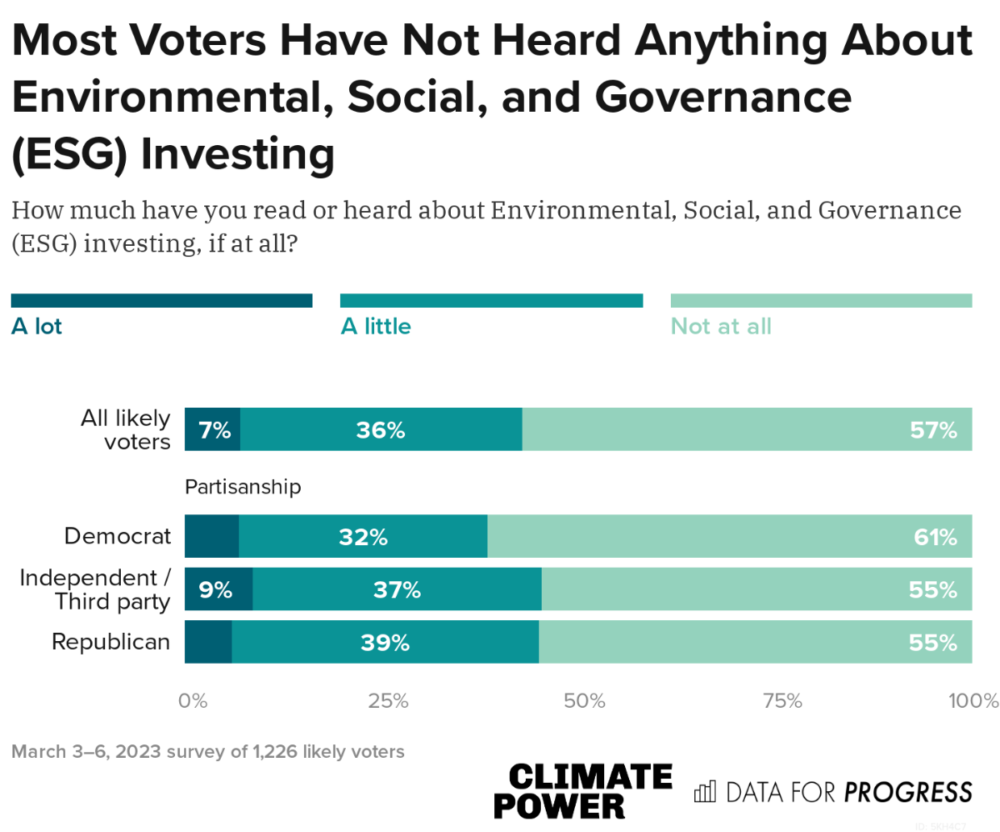

The first important thing to understand when covering or engaging in this fight is that it is largely happening inside a bubble. A majority (57%) of voters have never heard about ESG investing and only 7% of voters have heard a lot about it.

Lack of pre-existing knowledge aside, this is a winning debate for the White House and Democrats. A veto of the bill is favored by a 15-point margin while majorities support fund managers being allowed to consider environmental factors when making investment decisions for retirement funds, invest in clean energy and avoid investments in risky oil and gas companies.

Key Takeaways:

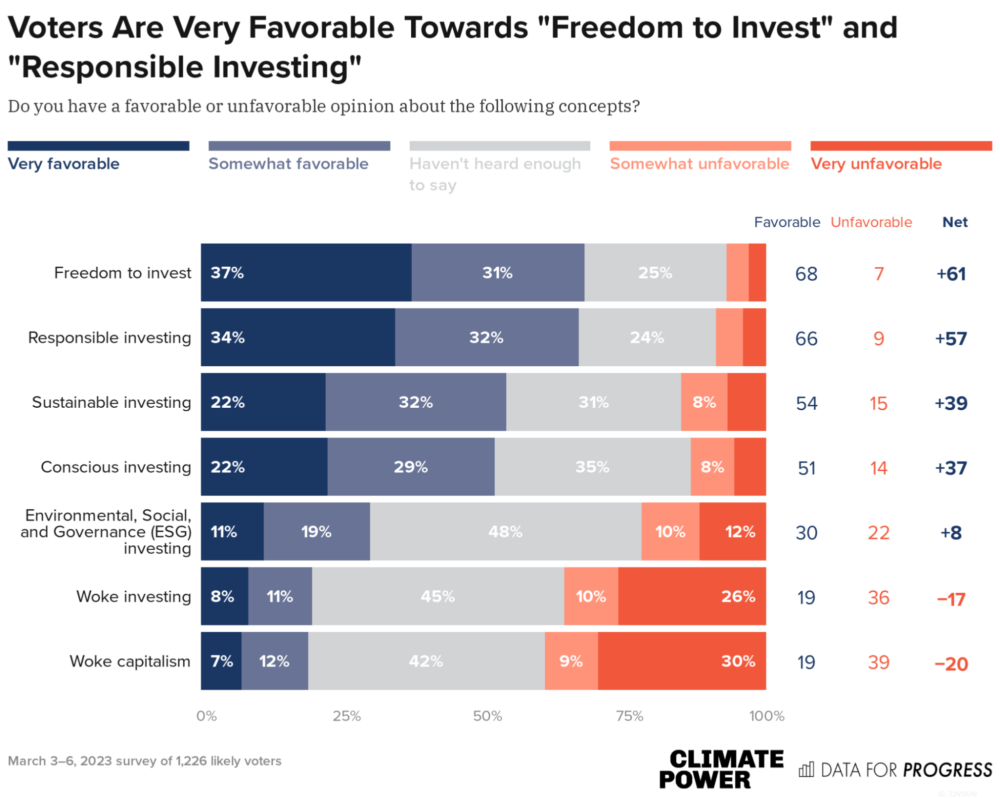

When communicating on the issue, Democrats should move away from the “ESG” terminology and use “freedom to invest” (favored by a 61-point margin) and “responsible investing” (favored by a 57-point margin). This is essentially a blank slate with voters and we should immediately frame it on our own, favorable terms rather than allowing Republicans to drive the narrative.

Just as important as the effectiveness of “responsible” or “freedom” framing is the ineffectiveness of the core Republican line of attack. When asked for an opinion on “woke investing,” a plurality have no opinion either way and just 36% have an unfavorable opinion. While this is, of course, a less desirable framing for proponents of responsible investments, it largely falls flat as a political attack. Democrats should not be concerned if this is thrown at them.

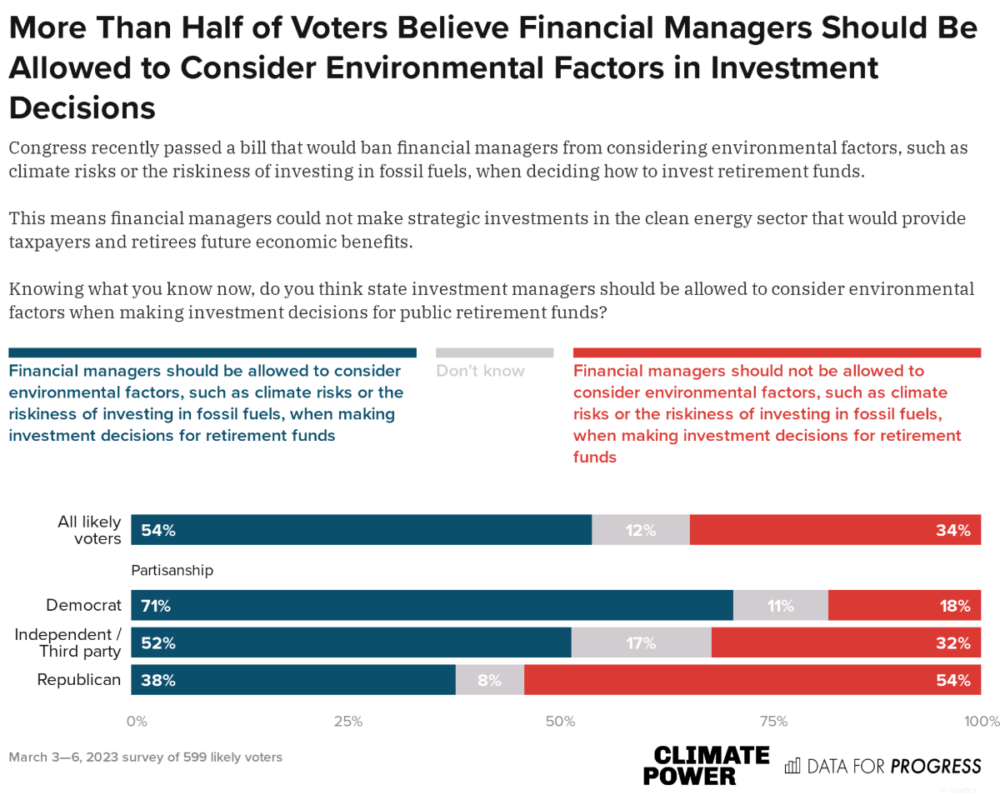

A majority (54%) of voters agree that financial managers should be allowed to consider environmental factors, such as climate risks or the riskiness of investing in fossil fuels, when making investment decisions for retirement funds with just 34% opposing.

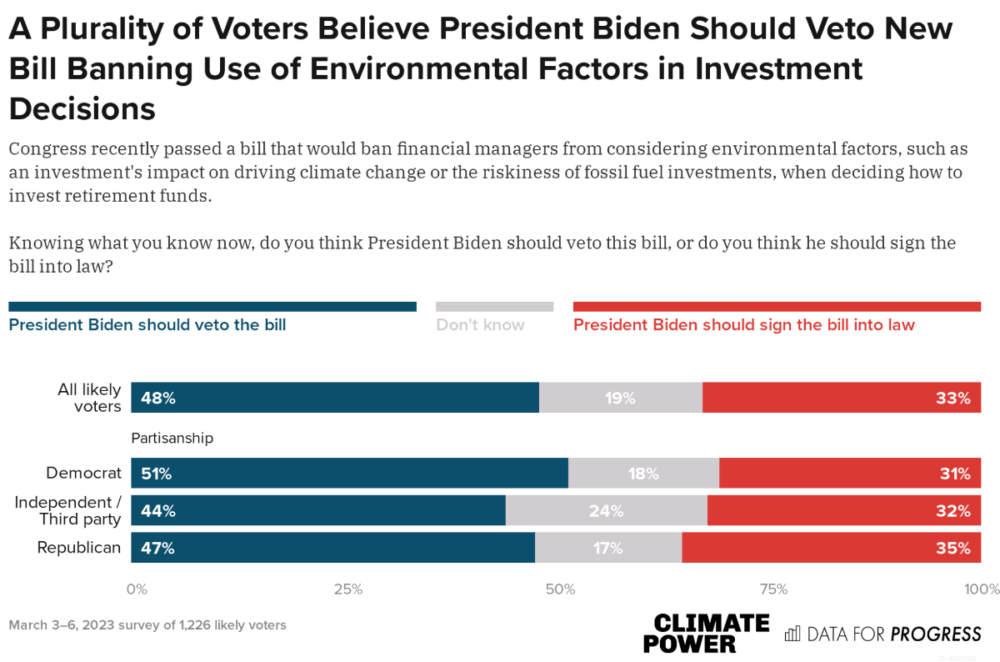

A plurality of voters (48%) support President Biden vetoing the recent bill banning financial managers from considering environmental factors in investment decision-making, while only 33% believe he should sign this bill

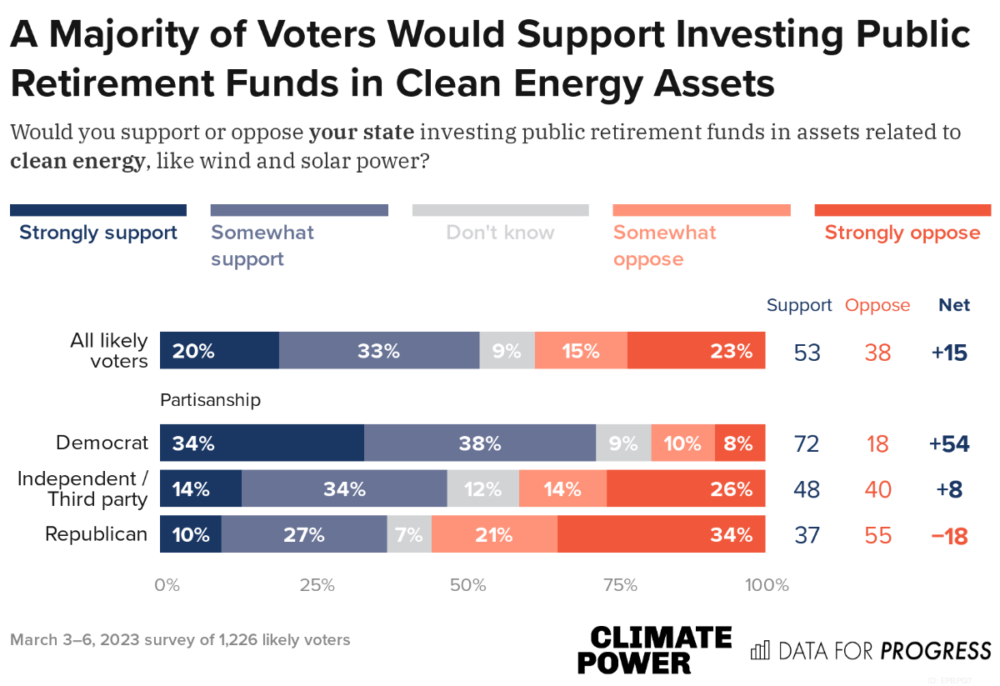

More than half of national likely voters (53%) support their state investing public retirement funds in assets related to clean energy

On the whole, respondents report low awareness of ESG investing, with only 7% saying they have read or heard “a lot” about the term, while 36% have heard “a little,” and 57% have not heard about ESG investing at all.

Conclusion:

While the national debate on responsible investing is just beginning, there is already real world evidence that this is a winning issue for Democrats. Efforts to ban state funds from analyzing climate risks have passed in Texas and Florida, resulting in their residents footing hundreds of millions of dollars in additional taxes. Due to the detrimental impacts of blocking responsible investing, states like North Dakota, Indiana, Kentucky, and Mississippi have managed to defeat similar proposals from passing in their states.

Democrats should go on offense and aggressively frame the argument early in support of President Biden’s first veto. Voters do not want fund managers to be told how to invest retirement funds and Republican efforts to do so will be a political loser—and contradictory to their party’s free market principles.

Methodology

From March 3 to 6, 2023, Data for Progress conducted a survey of 1,226 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, geography, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.