ICYMI: BIDEN CALLS OUT OIL COMPANIES FOR PROFITEERING OFF THE CRISIS IN UKRAINE

tags

FOR IMMEDIATE RELEASE

DATE: March 16th, 2022

CONTACT: Erik Mebust, erik@climatepower.us

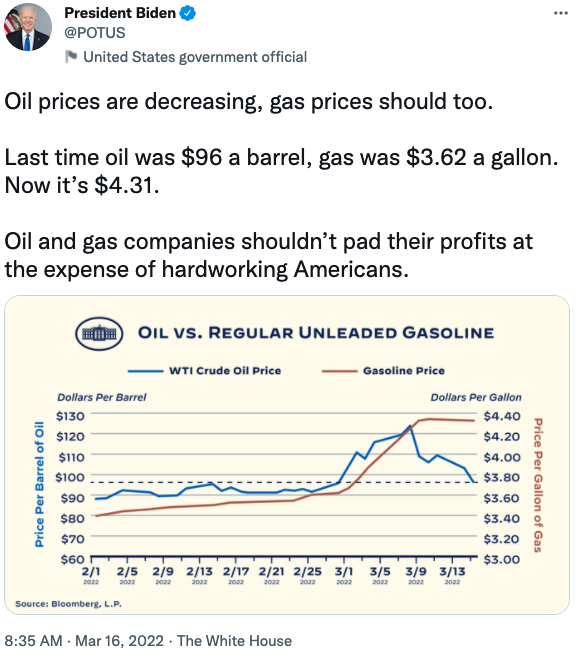

Washington, D.C. – This morning, President Biden and Senate Majority Leader Chuck Schumer called out oil company CEOs for profiteering off of Putin’s war against Ukraine.

After President Biden pointed to the outrageous fluctuation in the price of gas at the pump, Schumer announced that the Senate will call Big Oil to testify about high prices “very soon.”

Gas prices are still at near-historic levels, funneling money to Big Oil shareholders while American families suffer. Leading economists have identified the high price of oil as a leading obstacle to economic growth this year, and yesterday a group of national security leaders declared that our dependence on fossil fuels prevents us from true energy independence, with dire consequences for national security.

The public need not wonder about Big Oil’s position on these unaffordable prices. Fossil fuel executives have for months declared loudly and in public that they plan to keep prices high and continue to profit. As prices rose last year, the top 25 oil companies took home $205 billion in profits, with Chevron calling it one of its “most successful years ever.” Right now, the industry is choosing to keep supply tight and prices high so they can send $88 billion back to shareholders through stock buybacks ($38bln) and dividends ($50bln).

Here’s what Big Oil executives have said about high oil & gas prices:

ExxonMobil CFO Kathy Mikells

“I would actually say as we sit here in the near term that overall we’re generating more robust cash flows because we’re in a higher price environment, […] about a month ago when we announced our fourth quarter earnings result, we suggested that in light of the positive overall price environment, we would be at the shorter end of that 12 to 24 month period in terms of execution [of their share buybacks program] and I would say the price environment has only gotten stronger since we made that announcement.” [Exxon Mobil Investor Day, 3/2/2022]

“We expect to generate over $100 billion in excess cash flow beyond meeting our capital program and current dividend, and so I would say we have a very robust forward plan and we expect to have sustained excess cash flow and increasing shareholder distributions.” [Exxon Mobil Investor Day, 3/2/2022; Ycharts Brent Crude Oil Spot Price]

Pioneer Natural Resources CEO Scott Sheffield

In an interview in December 2021, CNBC’s Brian Sullivan asked Pioneer Natural Resources CEO Scott Sheffield: “Does the industry have an obligation to the public to pump more oil?” Sheffield replied: “We can’t because we have an investor contract. We can’t go back on our word. People have asked me at $100 oil at $150 oil are you going to grow more than 5% and the answer is no. We’re just going to return more cash back to the investor, so I just don’t think we have an obligation to grow production.” [CNBC, 12/7/2021]

Devon Energy CEO Rick Muncrief

“Now, as we shift our focus to the upcoming year, I want to be clear that there is no change to our cash return playbook. It will be more of the same. We will be relentlessly focused on delivering high returns with capital employed, margin expansion, accelerating free cash flow growth, and returning excess cash to shareholders.” [Devon Energy Q4 2021 Earnings Call, 02/16/2022]

“We will see the US doing their part to get additional barrels in the market, but for a publicly traded company such as ourselves, you know we’re going to try and keep production levels flat” […] “We’ve also announced a share repurchase program, so for your listeners we have a 1.6b approval, of which we’ve already in the fourth quarter of 2021, we repurchased $600 million dollars worth of our shares [for] a very attractive $42 a share price I might add, so we’ll continue to be opportunistic.” [Bloomberg TV, 02/28/20

“If you’re a seller, I mean, you’re wanting to sell at today’s prices. If you’re a buyer, you have to honor that curve. And that it’s kind of an interesting time. So that’s why as we talked here among this management team and with our board, we felt like the clear thing for us to do is to double down on our share repurchases.” [Devon Energy Q4 2021 Earnings Call, 02/16/2022]

Occidental President and Chief Executive Officer Vicki Hollub

“Occidental’s focus on operational efficiencies in the fourth quarter enabled us to leverage the increases in commodity prices to further improve our balance sheet and liquidity position, and set us on a path toward continued debt reduction and the implementation of a new shareholder return framework in 2022.” [Occidental Press Release, 02/24/2022]

Shell CEO Ben Van Beurden

“We have strengthened our balance sheet, provided significant shareholder distributions, and invested in the energy transition. So, let’s look at our delivery starting with the first goal of Powering Progress – generating shareholder value. We need to deliver shareholder value while we transition to the energy system of the future. And in July last year, we stepped up our dividend to a sustainable and more meaningful level in line with our cash generation. In 2021, we also announced share buybacks in the amount of $3.5 billion. And today we have launched an $8.5 billion share buyback programme and we expect to increase the dividend for Q1 2022.” [Shell 4th Quarter 2021 Earnings Presentation, 2/3/2022]

Chesapeake Energy CEO Nick Dell’Osso

“And our dividend program, we believe, is important to return cash to shareholders, particularly in times where like right now, you have pretty robust commodity prices that are generating cash flows well above where you believe you should invest.” [Chesapeake Energy Q4 2021 Earnings Call, 02/24/2022]

Kimmeridge Energy Management Co. Managing Partner Ben Dell (an energy investor)

“The only question investors should ask is why on earth would they want any U.S. [oil producer] to grow? The sector has been working. Cash flow is getting returned. This is not the time to change the [new] business model.” [Wall Street Journal, 2/18/2022]

###